Summary

I realized today that I can either be a winner or a loser and I want

to be a winner. In order to win, I must follow the rules I have in place

and develop better plans of action. As of now, my plans seem too weak.

In other news, it seems my emotions have been sucked dry. This is good because it seems I can feel no pain anymore.

Ticker: RXII

|

| Wow, it hit resistance and it just tanked like JOEZ. This has happened to me so many times and it must mean that I am cursed. |

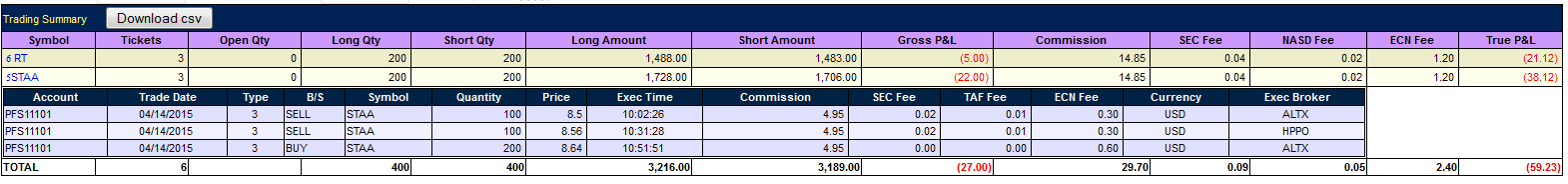

Ticker: STAA

|

| I bought this not respecting the trend. I did not even notice it. I did not allow it to retest prior highs and just got fucked. |

Note: I should not play in the front side of moves until I am more experienced.

Ticker: RT

|

| I felt like it might crack, but it held the trend so I took it off. This time, I was not going to fight trend. |

Note: I did a little better, but still averaged down before confirmation. I must stop doing that.

Please let me know if you have any comments or opinions. I would like to know if you have spotted any mistakes in my logic.